san francisco payroll tax calculator

Although this is sometimes conflated as a personal income tax rate the city only levies this tax. Gross Receipts Tax GR Proposition F was approved by San Francisco voters on November 2 2020 and became effective January 1 2021.

Here S How Much Money You Take Home From A 75 000 Salary

San Francisco Business and Tax Regulations Code ARTICLE 12-A.

. The city of San Francisco levies a gross receipts tax on the payroll expenses of large businesses. Name A - Z Sponsored Links. The payroll tax became effective on October 1 1970.

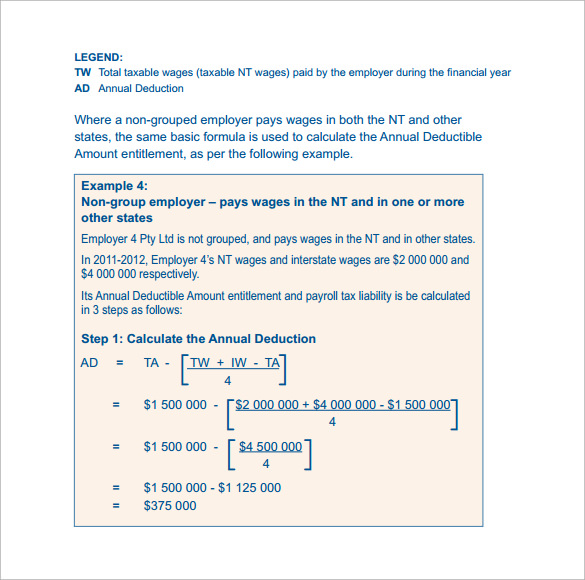

Since 2012 San Francisco has undergone many changes with its payroll and gross receipts taxation. Proposition F fully repeals the Payroll Expense. For the Gross Receipts Tax GR we calculate 25 of your Gross Receipts Tax liability for 2021.

This provision does not apply to annual earnings in excess of 123000. Intelligent user-friendly solutions to the never-ending realm of what-if scenarios. Until 2018 all businesses with a taxable San Francisco payroll expense greater than 150000 must file a Payroll Expense Tax Statement for their business annually by the.

Since 1995 the payroll tax rate has. If you make 55000 a year living in the region of California USA you will be taxed 11676. Over the years the payroll tax rate has changed from a low of 11 percent to a high of 16 percent.

Payroll Tax Calculator in San Francisco CA. Payroll Tax Salary Paycheck Calculator California Paycheck Calculator Use ADPs California Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. The payroll tax modeling calculators.

2022 Payroll Table Active Contracts Multi-Year Spending Positional Spending Financial Summary 2022 Free. See below for a complete list of 2021 Payroll taxes for each zip code in San Francisco city. That means that your net pay will be 43324 per year or 3610 per month.

Use the Free Paycheck Calculators for any gross-to-net calculation need. Quarterly Payroll Taxes Service in San Francisco California Quarterly Taxes Quarterly Payroll Taxes How to calculate quarterly payroll taxes When a business has employees for which they. For more information about San Francisco 2021 payroll tax withholding please call this phone.

Our payroll tax services are available in and around the California Bay Area North Bay South Bay and East bay including San Francisco. Name A - Z Sponsored Links. Well do the math for youall you need to do is enter.

The city of San Francisco levies a gross receipts tax on the payroll expenses of large businesses. From imposing a single payroll tax to adding a gross receipts tax on. Although this is sometimes conflated as a personal income tax rate the city.

Tax Return Preparation Accountants. If your 2021 gross receipts were less than 2000000 you do not have to pay any estimated. PAYROLL EXPENSE TAX ORDINANCE Sec.

Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in California. Although most states have their own versions of a quarterly tax. ASR Tax Financial Services.

Payroll Tax Calculator in South San Francisco CA. At quarter end we will prepare and electronically submit the 941 Federal Payroll tax return and the applicable states returns. Discover the payroll service youve been searching.

Free 7 Sample Payroll Tax Calculator Templates In Pdf Excel

Easiest Fica Tax Calculator For 2022 2023

California Paycheck Calculator Smartasset

Should You Move To A New City To Increase Your Income Four Pillar Freedom

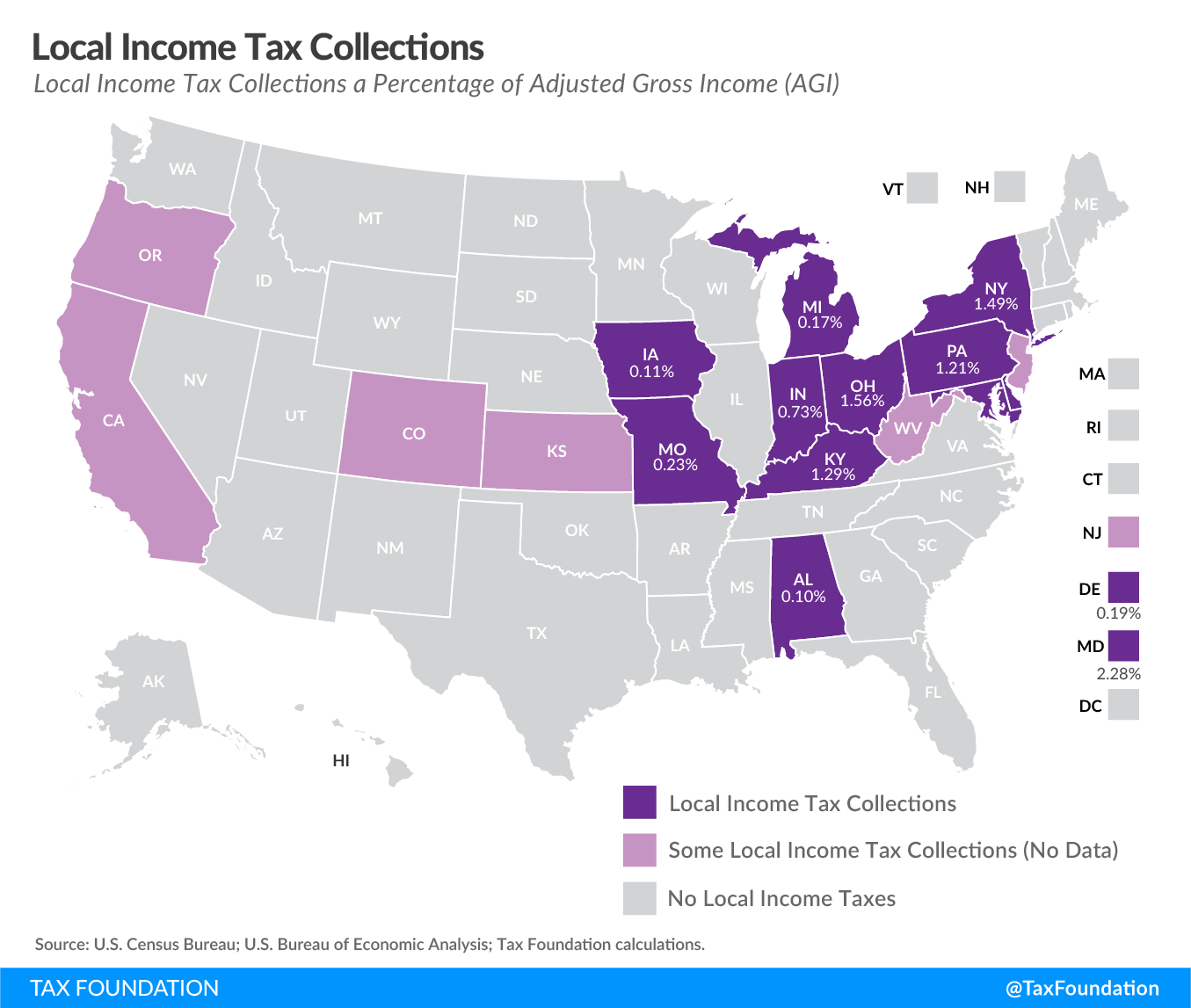

Local Income Taxes In 2019 Local Income Tax City County Level

Free Llc Tax Calculator How To File Llc Taxes Embroker

Solved People Friendly Computer Inc With Headquarters In Chegg Com

What Do Nfl Players Pay In Taxes Smartasset

Federal Income Tax Return Calculator Nerdwallet

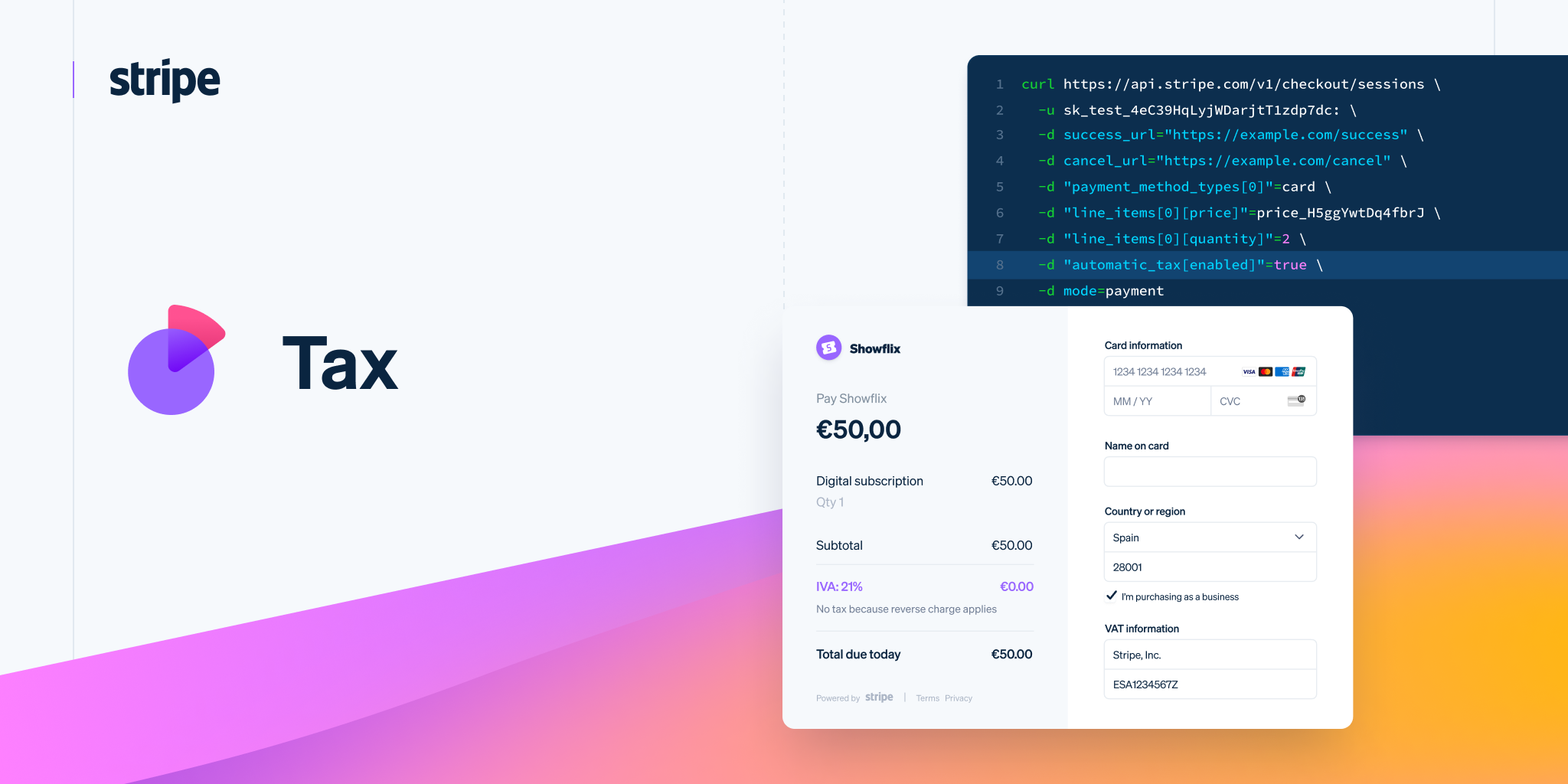

Stripe Tax Automate Tax Collection On Your Stripe Transactions

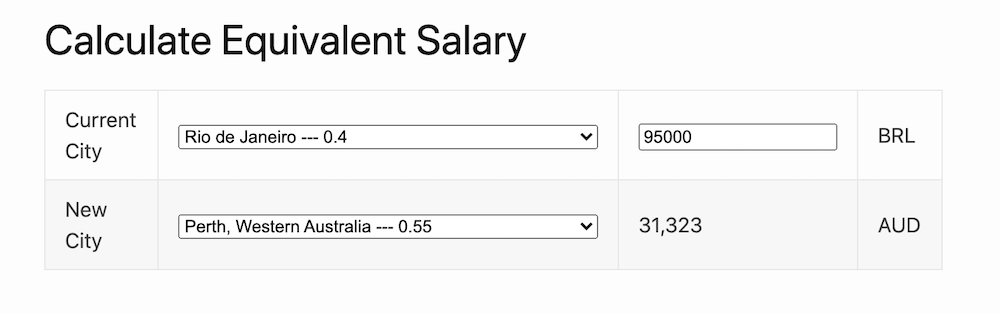

Equivalent Salary Calculator By City Neil Kakkar

:max_bytes(150000):strip_icc()/buying-vs-renting-san-francisco-bay-area-ADD-V2-d0efaf2b7ac346bbba2c1ac389751ef1.jpg)

Buying Vs Renting In San Francisco What S The Difference

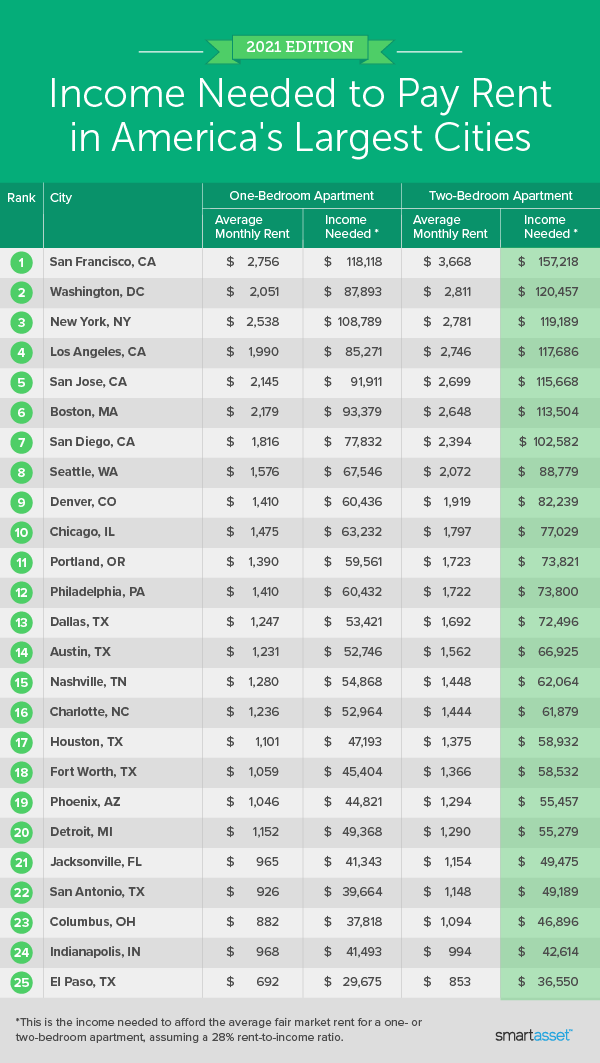

Income Needed To Pay Rent In The Largest U S Cities 2021 Edition Smartasset

New Tax Law Take Home Pay Calculator For 75 000 Salary

Payroll Calculators California Payroll

Salary Paycheck Calculator Calculate Net Income Adp

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time